Effective January 1, 2024, the Government of Ontario introduced a new endorsement to the Ontario Auto Insurance Policy (OAP 1) named OPCF 49: Agreement Not to Recover for Loss or Damage from an Automobile Collision.

This change allows consumers to opt out of Direct Compensation Property Damage (DCPD) coverage by signing the OPCF 49 form. It offers more flexibility in balancing coverage versus cost on your car insurance policy.

Here’s what this means for you:

You now have the option to remove DCPD coverage, which normally pays for vehicle damage in accidents where you’re not at fault.

By opting out, you may save on your car insurance premium.

However, you’ll also be responsible for any repairs to your vehicle even if you’re not at fault in a collision.

This change gives you more control over your insurance costs but also requires careful consideration of your risk tolerance.

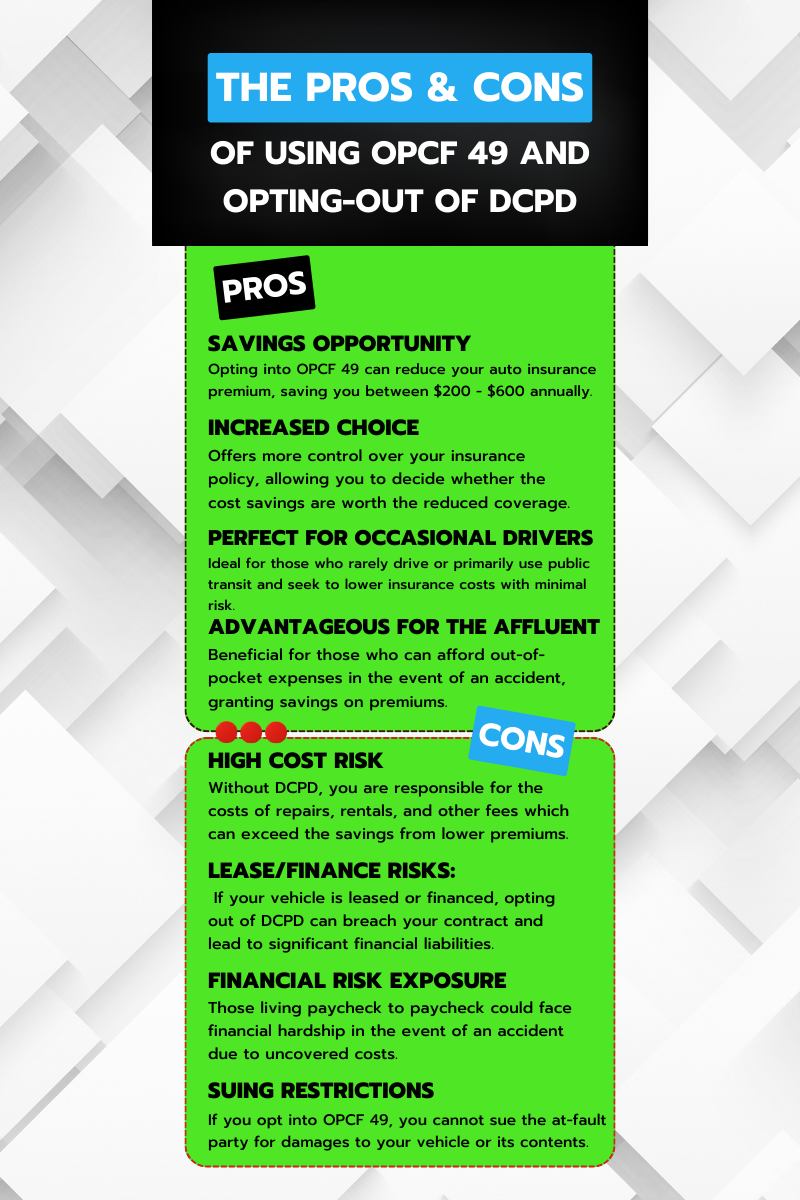

Effectively, OPCF 49 removes coverage for not-at-fault accidents in exchange for potential savings. But is the savings worth the lack of protection? What are the pros and cons of OPCF 49, and what can you expect?

We’re here to help you navigate this new choice and make the right decision for your Ontario car insurance policy.

To better understand the implications of OPCF 49, it's essential to grasp what DCPD means in the context of Ontario's auto insurance. Introduced in 1990, Direct Compensation Property Damage (DCPD): Otherwise known as No-Fault Insurance, this coverage responds when someone crashes into your vehicle, in Ontario, and it is determined you are not at fault. Damage to your vehicle and contents is covered with no deductible. It is called “No-Fault” because, even though the other person is at fault, you may call your own insurance company to cover the damages rather than chasing the third party and their insurance company. Even if you have an older vehicle that is not worth insuring, you still must have this coverage, and it comes standard on every Ontario auto insurance policy. Learn more about types of coverages in Ontario here.

Ontario has been through many auto insurance reforms over the past decade or so, largely due to how expensive auto insurance is in Ontario. Attempts have been made to rein in fraud, to reduce accident benefits coverage, and to mandate rate decreases across the board. While these efforts have met with varying degrees of success, the Ontario Government has added one more cost-saving option in the OPCF 49. Is this more of a political move or a practical one for consumers? We’re not here to discuss politics, but we are here to give consumers choice and a thorough explanation of the costs and benefits.

The average cost of car insurance in Ontario in 2023 is $2,800 annually for one vehicle. There is an indication that the higher the total premium of the policy, the lower the percentage of the DCPD portion of the total premium. The DCPD portion of the premium is anywhere between 15% to 30%. This means that the average cost, or savings, of DCPD is somewhere between $200 - $600. These savings, while substantial, should be weighed against the potential costs of having a not-at-fault accident in Ontario. In these types of accidents, the cost of towing, storage, and rental car are covered under DCPD. Once you use the OPCF 49, none of these costs are covered, not to mention the cost of repairs. This can create a rather risky proposition where there might not only be no savings, but there could also be financial difficulty caused by opting out of DCPD.

By now, you might be wondering, “Should I use OPCF 49?”

The OPCF 49 endorsement was designed to give Ontario drivers more flexibility, specifically, to let them opt out of Direct Compensation Property Damage (DCPD) coverage and reduce their insurance costs. But the real question is: who truly benefits from opting out?

The OPCF 49 form could make sense for drivers who:

Rarely drive their vehicle and have a very low risk of being involved in an accident.

Own an older car with low market value, where repair costs might exceed the car’s worth.

Can comfortably afford out-of-pocket costs like towing, storage, rental cars, or repairs after an at-fault or not-at-fault collision.

Are seniors or city dwellers who rely mostly on public transit and only use their car occasionally.

Want to minimize monthly premiums and understand the trade-off between coverage and savings.

For these drivers, OPCF 49 can help reduce premiums slightly while maintaining minimal risk exposure, though it still comes with potential downsides.

On the other hand, this endorsement may not be suitable for those who:

Rely on their car daily for commuting, work, or family needs.

Cannot afford sudden repair or replacement costs if their car is damaged in a not-at-fault accident.

Live paycheck to paycheck or prefer predictable, comprehensive coverage without unexpected expenses.

Own a newer or financed vehicle, as lenders or leasing companies often require full coverage.

Value peace of mind and don’t want to risk paying thousands out of pocket after an accident.

Essentially, the people who may need to save money the most are also the ones who can least afford the financial impact of losing DCPD coverage.

So, does OPCF 49 truly save money for the right people? Not always. The endorsement may be most useful for low-risk drivers or those with strong financial flexibility.

Even for them, however, the risks still remain, because once you opt out, you give up the right to claim DCPD coverage if you’re not at fault in a collision.

People opting out who can least afford to use this endorsement are the ones who will seek it out. DCPD coverage was made for good drivers who are having a bad day when someone crashes into them. They can claim for expenses and repairs from their own insurance company with no deductible. For those customers looking to save $300 by not having DCPD, they could incur hundreds or thousands more by not having DCPD coverage, money they absolutely cannot afford. The downside of the OPCF 49 is that it can have the unintended effect of making the most vulnerable people even more susceptible to financial hardship in the event of an accident that is not their fault.

If you are leasing or financing, your vehicle you have a contract in place with the Financing Company. In that agreement it states that the vehicle must be covered for Physical Damage in the event of an accident. If you opt-out of DCPD and Collision coverage, you are opting out of Physical Damage coverage and are in breach of your contract with your Finance Company. Not only does the company have the ability to take away your financing but you would also owe them the value of the vehicle if it was involved an accident. You would have to pay the Financing Company the damages out of your pocket.The Globe and Mail has recently stated that the average price of a car in Canada is $66k. Not many consumers could afford to pay back the Finance Company that amount of money in the event of an accident. Basically, if your car is financed or leased, the OPCF 49 is not for you.

DCPD: “Direct Compensation Property Damage” is a mandatory coverage as discussed earlier. An insured will be compensated by their insurer in the event that they are involved in a not-at-fault or partially-at-fault collision. Under DCPD, the client is compensated for the following: Repairs to the vehicle, the full value of the vehicle or a replacement, a rental vehicle (loss of use), contents in the vehicle, and towing & storage.

Now that we've discussed the intricacies of DCPD and OPCF 49, let's look at some practical examples to illustrate how these coverages work in real-world scenarios. These examples will help you understand the tangible benefits and implications of choosing with or without DCPD coverage, and how OPCF 49 can affect your claims and costs in different situations

Cost of DCPD Coverage: @$500 annually

Incident: This party rear ends your vehicle

Fault: Third Party 100% At-Fault

Vehicle Value: $66k

Vehicle Damage: $20k

Deductible: $0

Towing, storage and rental car (1 week): $300 + $700 + $700 = $1700

Insurer Pays: $20k repairs + $1700 costs = $21700

Cost of DCPD Coverage: $0 – Opted Out

Incident: This party rear ends your vehicle

Fault: Third Party 100% At-Fault

Vehicle Value: $66k

Vehicle Damage: $20k

Deductible: $0

Towing, storage and rental car (1 week): $300 + $700 + $700 = $1700

Insurer Pays: $0

The answer to that question lies solely with the customer, however, only if they are completely informed with all the information necessary to make an educated decision. This decision should be made after seeking advice from a broker and weighing the financial costs vs. benefits at stake for the customer. In our opinion, there are far better ways to save on car insurance without resorting to removing fundamental coverage under the Auto Policy. Shopping online, bundling discounts, telematics programs, group discounts, tailoring or trimming coverage, etc. may all help to achieve the desired result of a well-priced auto insurance policy. It is widely anticipated that less than 1% of Ontario drivers will opt-in to the OPCF 49. If you are among those 1% it is in your best interest to stay informed. It is our job to help you with that.

Want to dig even deeper into OPCF 49? Let's answer some common questions through our FAQ section, providing you with clear, concise answers that cut through the complexity. Whether you're pondering its benefits or weighing the implications, we've got you covered with these insightful responses.

The government of Ontario introduced this change to provide consumers with choice and potential cost savings.

There is no requirement to proactively send out notice to all clients because DCPD remains a mandatory coverage on the Ontario Auto Insurance Policy. The OPCF 49 is an optional endorsement and so there is no requirement to notify clients of this change. Clients may contact their broker to inquire further.

3. What does it mean to unselect DCPD or opt into the OPCF 49 endorsement?

If you are involved in an accident for which you are not at-fault, or partially-at-fault, you will be responsible for the following costs:

Auto repair to damages

The total value of the automobile or its replacement

A temporary rental car (loss of use)

Damage or loss of the contents inside the car

The OPCF 49 also extends to Collision coverage, so this means you are on the hook if they are in an at-fault accident too. Basically no motor vehicle accident damage, or related costs are covered.

Yes. Towing costs will no longer be covered including hookup, delivery, storage and pickup.

No, they may not sue. As per Section 263 of the Insurance Act, “an insured has no right of action against any person involved in the incident other than the insured’s insurer for the damages to the insured’s automobile or its contents or loss of use.”

Yes, there are premium savings but they must be weighed against potential costs as well. Short term savings may not equal long term savings, and in many instances, the costs could be greater.

Consumers must sign the OPCF 49 pdf form if they elect not to recover for DCPD. However, in addition to this form, Brokers are likely to provide further explanation as to the consequences the consumer assumes by choosing the OPCF 49 and have them acknowledge such in writing.

Policyholders who sign an OPCF 49 agree to terms that there is no coverage under Subsection 7.1.2 C – Collision or Upset for the specific vehicle listed on the form. The vehicles are listed by VIN number, so the coverage is specific to the listed vehicle on the form.

Yes. As with all OPCF change forms, the insurance company must make the option available to all consumers.

If the consumer leases or finances a vehicle, they should not request an OPCF 49 without discussing with the lease or financing company first because they may be personally financially responsible for loss or damage to the vehicle. By signing an OPCF 49 the customer is likely in breach of their financing or lease agreement.

A good candidate would be someone with the financial means necessary to pay for all of the associated expenses such as towing, storage, rental car and repairs. Customers who are looking for small savings on a premium are likely not good candidates for the OPCF 49 if they are not able to pay for the expenses associated with an accident.

If you found this information on OPCF 49 insightful, be sure to explore our other blogs for more valuable insights and tips on auto insurance and other related topics. Stay informed and make the best decisions for your needs!