Car Insurance in Ontario is required by law, this is a fact. However, did you know that only certain types of car insurance are mandatory, while some are optional? Do you know what is required of you as opposed to what you should purchase in addition to the minimum mandatory coverage? In this article, we will break down the minimum legal requirements, the optional coverages you should have, as well as the coverages that are nice to have. We will also discuss their impact on auto insurance rates and how to make sure you have the right amount of coverage. Not too little, not too much, just right.

Ready to find your ideal car insurance coverage? Use Begin Insurance's Online Auto Insurance Quoter for a quick and personalized quote.

Click Here to Start Your Quote

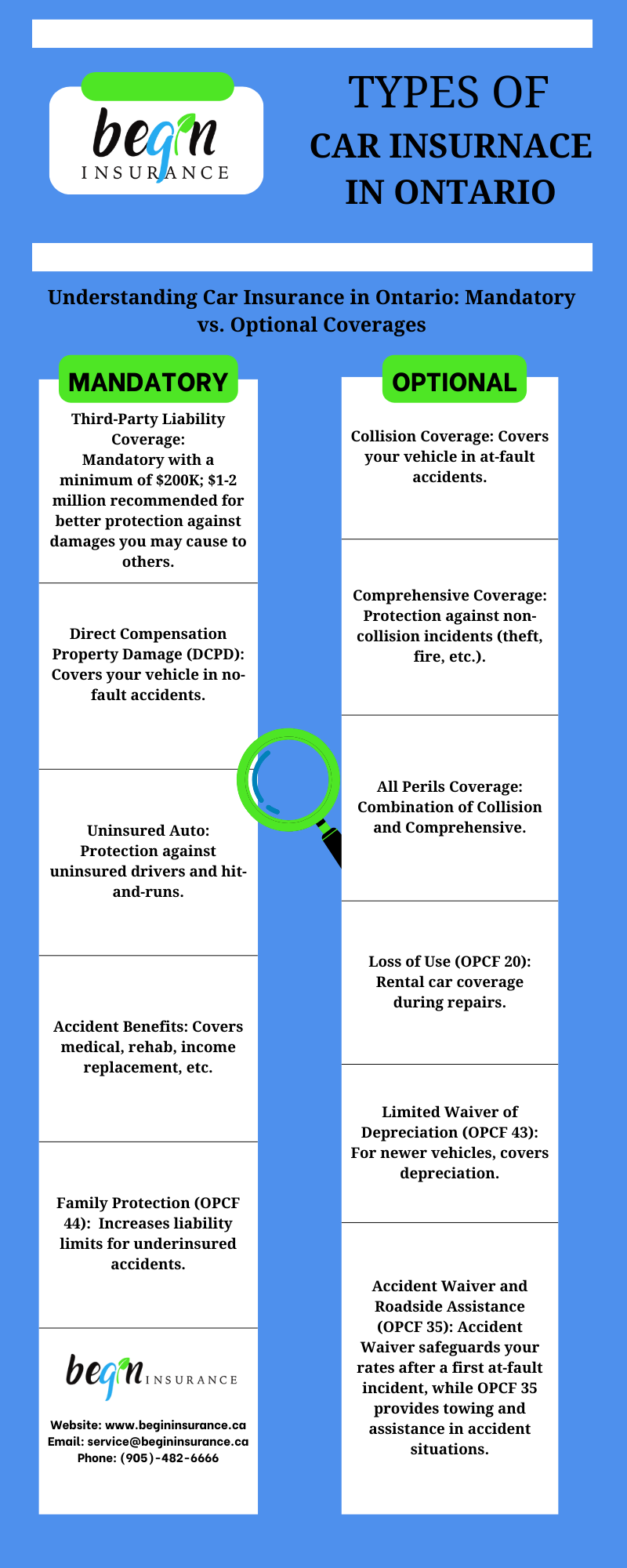

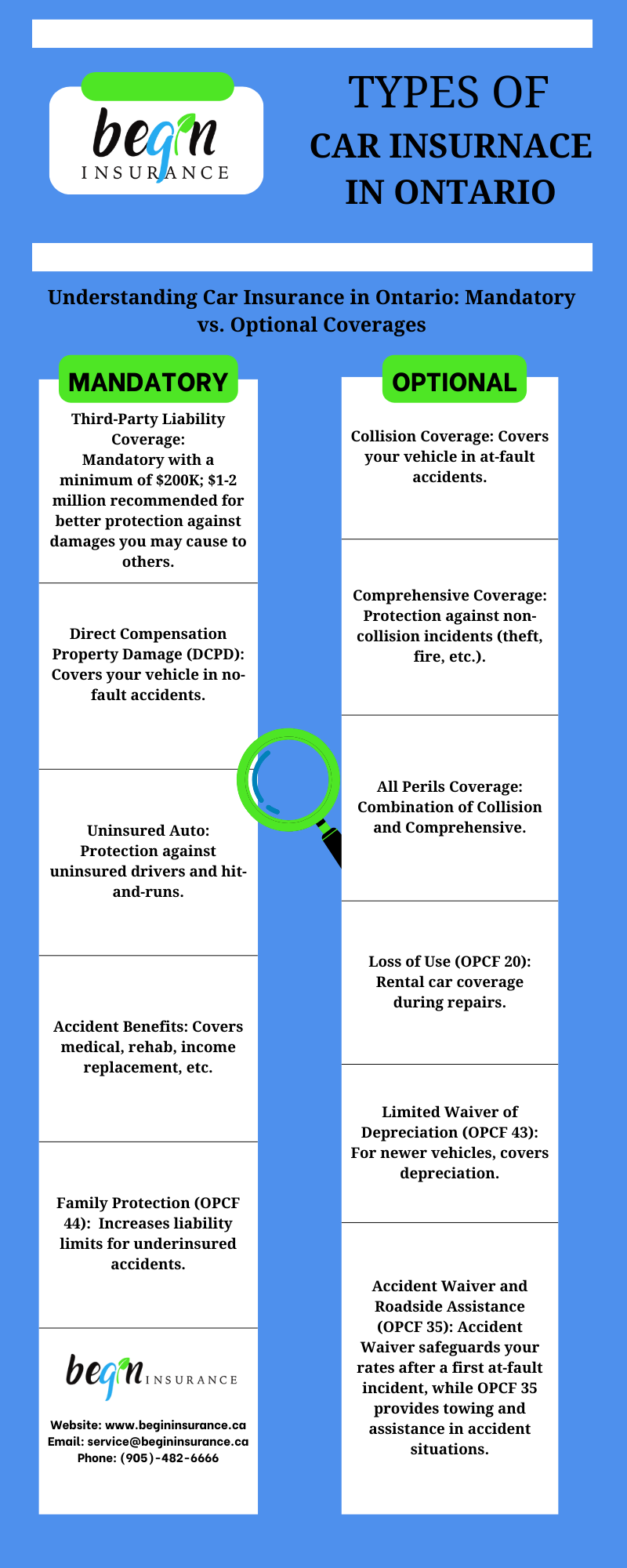

Mandatory Car Insurance in Ontario

Here are the minimum legal required coverages you must have to drive in Ontario:

- Third-Party Liability Coverage: In Ontario, this comes standard with every auto insurance policy and is a must-have. It protects you from damages you may cause, including injury to others and property damage. The legal minimum is $200,000, however, it is highly recommended and normally sold at $1 million or $2 million in coverage. The difference between $1 million and $2 million is approximately $50 annually and highly recommended.

- Direct Compensation Property Damage (DCPD): Otherwise known as No-Fault Insurance, this coverage responds when someone crashes into your vehicle and it is determined you are not at fault. Damage to your vehicle is covered with no deductible. It is called “No-Fault” because even though the other person is at fault you may call your own insurance company to cover the damages rather than chasing the third party and their insurance company. Even if you have an older vehicle that is not worth insuring you still must have this coverage and it comes standard on every Ontario auto insurance policy. However, Effective January 1, 2024, Ontario drivers may opt out of DCPD using OPCF 49, making it technically optional—but highly discouraged due to potential financial risks. Opting out with OPCF 49 could lead to financial risks in no-fault accidents. Hence, you still see it under mandatory section. For an in-depth analysis of OPCF 49, see our detailed discussion How Will OPCF 49 Impact Your Car Insurance in Ontario?

- Uninsured Auto: This covers you for any bodily injury to yourself or damage to your automobile caused by someone who is uninsured or leaves the scene of an accident in a “hit and run”.

- Accident Benefits: This mandatory coverage includes several components, each with standard amounts that can be upgraded:

- Medical, Rehabilitation and Attendant Care: Up to $65,000 for non-catastrophic injuries, and up to $1 million for catastrophic injuries. Optional upgrades are available up to $130,000 and $2 million respectively.

- Income Replacement: 70% of gross income to a maximum of $400 per week. Optional limits of $600, $800, or $1,000 per week can be selected.

- Caregiver Benefit: Standard coverage applies only to catastrophic injuries with $250 per week for the first dependant and $50 for each additional dependant. This can be extended to non-catastrophic injuries.

- Housekeeping and Home Maintenance: Up to $100 per week for catastrophic injuries. Optional extension to non-catastrophic injuries is available.

- Death and Funeral Benefits: Provides $25,000 to a spouse, $10,000 per dependant, and up to $6,000 for funeral costs. These can be increased to $50,000, $20,000, and $8,000, respectively.

- Dependant Care Benefit: This is not included in the standard policy but can be added to provide up to $75/week for the first child and $25/week for each additional child, provided you are employed at the time of injury.

- Indexation Benefit: Optional. This adjusts benefit limits annually based on inflation using the Consumer Price Index (CPI).

- Family Protection Coverage (OPCF 44): This coverage bumps up your third-party liability limits if are ever involved in an accident with someone who is underinsured or is not insured. Basically, it protects your family by allowing you to sue and recover money from others who didn’t buy enough insurance.

Some misconceptions about mandatory car insurance are that it’s too expensive, especially for older vehicles. However, most of this coverage is for bodily injury, either yours or someone else's. Remember: cars can be replaced, people cannot.

Optional Car Insurance in Ontario

Here are the optional coverages you may purchase for your Ontario auto insurance policy:

- Collision Coverage: This coverage is for damage to your own vehicle. If you hit another vehicle or object and cause damage to your car this coverage will pay for the damage, minus your deductible. Common deductibles nowadays are $500 or $1000. Consider a $1000 deductible if you want to save $100 or more per year.

Here’s an example of a collision claim in Ontario:

Vehicle damage to your car: $10000

Percentage at fault: 100% your fault

Deductible: $1000

Collision payout by Insurance Company: $9000

Total Payout: $9000 on a $10000 claim

Here’s another example including Collision and DCPD with 50/50 at Fault:

Vehicle damage to your car: $10000

Percentage at fault: 50% your fault

Deductible: $1000 (you owe 50%)

Collision payout by Insurance Company: $4500

DCPD Payout by Insurance Company: $5000

Total Payout: $9500 on a $10000 claim

- Comprehensive Coverage: Covers the cost of damage to your own vehicle from non-collision related accidents such as theft, vandalism, fire, hitting an animal, etc. Also subject to a recommended deductible of $1000 or $500. There are some exclusions such as theft by someone who resides in your own home, theft by a mechanic.

- All Perils Coverage: It’s basically Collision and Comprehensive combined and removes the exclusion for theft from people in your home. It also tends to be a few dollars cheaper for some reason. This is the smart move to purchase rather than collision and Comprehensive.

- Loss of Use (OPCF 20): In the event of an accident where you need a rental car while your car is being fixed or replaced, the OPCF 20 coverage provides you with a rental, up to a specific limited dollar amount.

- Limited Waiver of Depreciation (OPCF 43): If your vehicle is new you’ll want to cover it for depreciation in the event of a loss. This coverage does just that for a specified period of time. While this coverage isn’t mandatory for newer vehicles, it may as well be. It’s a must have for newer owned or leased vehicles.

- Accident Waiver, Accident Forgiveness: If you have a good driving record with no recent claims you may want to purchase Accident Waiver coverage. In the event of your first At-Fault accident this coverage would essentially “forget” that a claim happened, allowing for your rates not to increase as a result. It’s essentially insurance on insurance. It’s important to note that this is not transferrable to another insurance company, meaning that only your current company will “forgive” the accident.

- Emergency Roadside Assistance (OPCF 35): This coverage responds in the case you are in an accident and need a tow or assistance. The cost for the tow will be covered by your insurance company. Note that this only applies to insured losses such as an accident. The cost is often $25 - $50. If you already have a membership with a roadside assistance plan such as CAA then this coverage really isn’t necessary.

There are a plethora of additional optional coverages for your Ontario Car Insurance policy but we’ve covered the main ones here. For each of the optional coverages it is important to look at your own particular needs and assess whether you would benefit from these coverages or not. Ask yourself; do I need a rental car to get to work? Do I already have roadside assistance? Do I have a good driving record worth protecting? If I get in to an accident can I buy another vehicle with the insurance money or can I go without coverage and buy my own car? It’s questions like these that are often best discussed along with an insurance broker to get the right price and coverage. Ready to take the next step? Get a personalized quote in as less as 30 seconds!

Start Your Quote Now

Important Update: Changes Coming in 2026

The Ontario government is restructuring accident benefits effective July 1, 2026. Here’s what’s changing:

- Only Medical, Rehabilitation and Attendant Care benefits will remain mandatory.

- All other benefits, income replacement, caregiver, housekeeping, death and funeral, dependant care, and indexation—will become optional.

- Policyholders must opt in to maintain similar protection levels. If no action is taken, coverage may be significantly reduced.

Source: pmplaw.ca

FAQs: What Ontario Drivers Ask Most

Q: What happens if I choose not to upgrade my mandatory coverage?

A: While the minimum coverage meets legal requirements, it may not be enough to fully protect your assets in the event of a serious accident. It’s recommended to upgrade your liability coverage to at least $1 million, as it can save you from financial strain if you're involved in a lawsuit.

Q: Is it worth opting out of Direct Compensation Property Damage (DCPD)?

A: Opting out of DCPD can save on premiums, but it’s a risky decision. Without this coverage, you’ll have to pursue compensation from the other driver’s insurer in the event they’re at fault, which can be time-consuming and financially uncertain.

Q: What is the difference between all-perils and comprehensive coverage?

A: All-perils coverage combines both collision and comprehensive coverage, including theft by people in your household. Comprehensive covers non-collision incidents like theft, vandalism, and fire, but doesn’t cover theft by household members.

Q: If I have an older car, should I still buy collision and comprehensive coverage?

A: It depends on the value of your car and your ability to cover repair or replacement costs. For older cars, some drivers choose to skip these coverages to save money, but this leaves them responsible for the full cost of repairs in case of an accident or non-collision damage.

Q: Are there discounts available for good drivers or low-mileage drivers?

A: Yes, many insurers offer discounts for drivers with clean records or those who drive fewer miles. If you don’t commute often or have a track record of safe driving, make sure to ask your broker about potential discounts.

For a quick visual summary of the key points discussed in this article, take a look at our infographic below. Don’t forget to share it if you find it useful.

Interested in more insights on insurance? Explore a wide range of topics on our blogs page.

Blogs